Money Week and the ARBs - September 2019

Money Week 2019 is an annual awareness campaign run by the Commission for Financial Capability (CFFC). It involves resources, tools, activities, seminars, and events to build better financial capability for New Zealanders.

This year Money Week runs from 9th-15th September 2019, and the focus is conversations about money. In 2018 the focus was planning for financial resilience.

Money Week website

The Money Week website provides resources to start conversations about money, as well as other tools and resources for adults and young people.

Assessment Resource Banks

The Assessment Resource Banks (ARBs) can be used to explore student understanding about a number of financial literacy ideas.

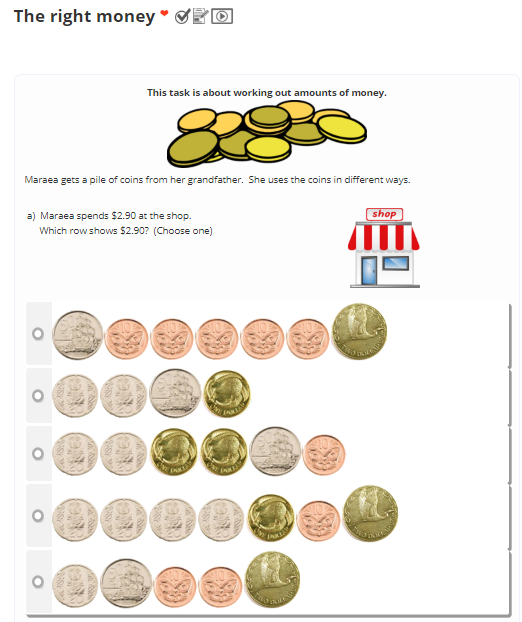

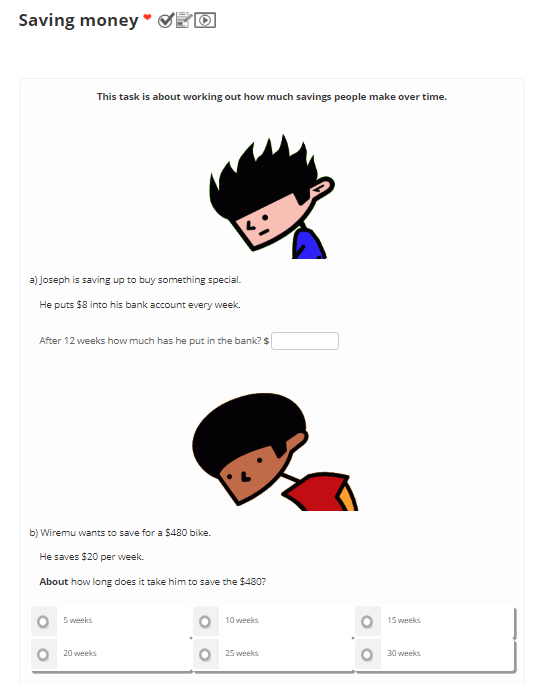

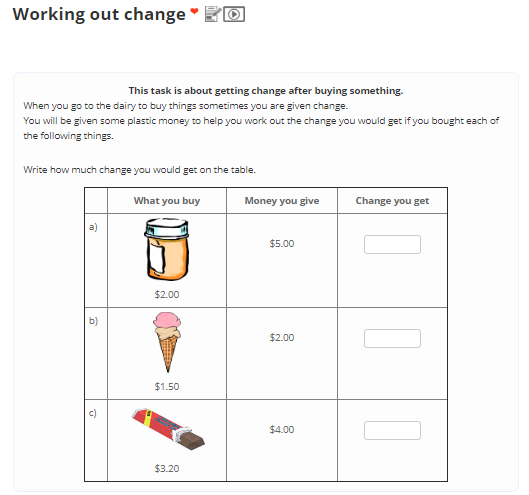

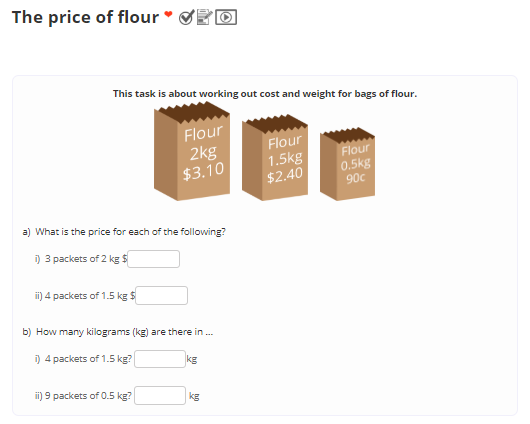

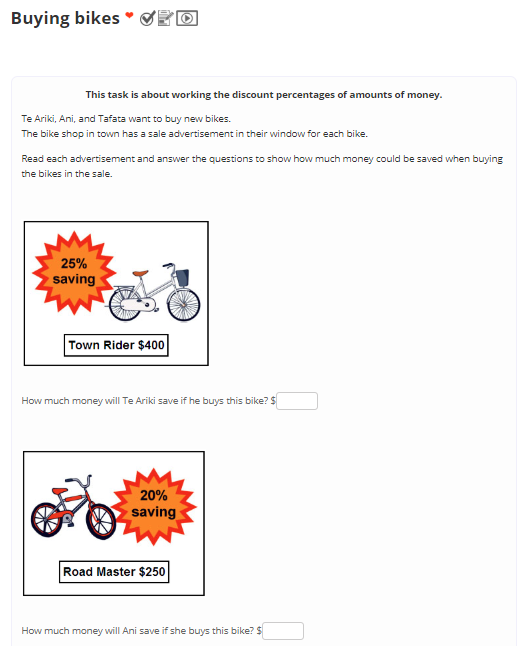

Many ARB resources look at counting money, spending, change, banking, saving, comparing costs, credit and debt, income, taxation, percentages, GST, and discounts. You can use these, or other, keywords to search for the resources you want and save them to your folders.

A selection of Number and Algebra ARBs that connect to financial literacy themes are shown below. These can be as starting points for conversations about particular financial capability themes.

Financial literacy and capability resources

There are a number of websites that have tools and resources to support teaching and learning about financial literacy and financial capability.

TKI

TKI hosts a range of resources about money conversations, financial literacy, and financial capability.

Financial capability progressions

The financial capability progressions can provide a structure for exploring financial capabilites in three areas: managing money and income, setting goals, and managing risk.

Sorted in Schools

In late 2018 the Commission for Financial Capability (CFFC) launched the Sorted in Schools website, which provides a number of resources to support the teaching and learning of financial capability for secondary students. These searchable resources are available in te reo Māori and English, and link to the themes and cross-curricular links of the financial capability progressions.

Sorted

The Sorted website has a range of financial tools. Anybody can set up a profile and use the many tools and resources available in both te reo Māori and English.

The ARB team